Firts draft citizen budgets a4 size

REPUBLIC OF THE GAMBIA

MINISTRY OF FINANCE AND ECONOMIC AFFAIRS (MOFEA)

BUDGET OF THE GOVERNMENT

OF THE GAMBIA

2014 CITIZENS EDITION

Republic of The Gambia Citizens Budget Manual

Table of Contents

List of Abbreviations or Acronyms

Statement by the Honorable Minister

Section I: Introduction

What Government wants to achieve from publishing the 2014 Citizens Budget

How the 2014 Budget helps to deliver the Development Promises of Government

What the 2014 Budget means to me and How it was Put Together

Section II: Economic Opportunities and Challenges and how it Impacts What Government Plans to Achieve in 2014

The 2014 Budget and how it fits the Economic Realities in and outside The Gambia

How some of the Envisaged Revenues and Expenditure in 2014 may differ from the Budget

What Government Plans to Achieve in 2014

The Policy Objectives/Challenges of Government in 2014

Government's Chosen Policy Measures for Achieving the Policy Objectives/Challenges

A. Revenue Measures

B. Other Policy Measures

Section III: Where Government Plans to Raise and Spend Money in 2014

Where the Money is Coming From and How

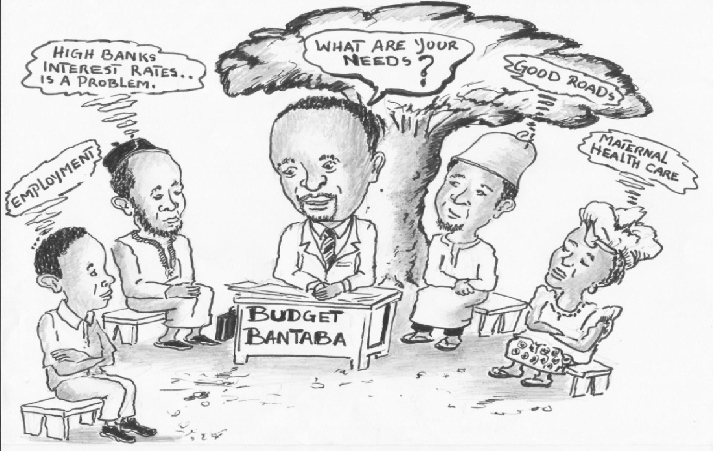

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

How Government Plans to Spend.

How Government will Distribute Recurrent and Development Expenditure between Departments and Ministries

Highlights of the Top Spending Ministries

Share of Poverty Expenditure During the PAGE Period

Spending in Critical Sectors

Section IV: New Initiatives and Contributions to Policy Objectives

The Main Budget Initiatives in 2014

Contributions of 2014 Budget to Meeting the Government's Policy Objectives

Section V: Improved Delivery of Services

What Government is doing to Improve Service Delivery in 2014 32

Section VI: Appendices

Photo Gallery of Development Projects

Participants at the Validation Workshop of the 2014 Citizens Budget

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

List of Abbreviations or

Abbreviations or

Economic Community of West African States

Gross Domestic Product

Government Local Fund

Information, Communication and Technology

Ministries, Departments and Agencies

Micro, Small and Medium Enterprises

Medium Term Expenditure Framework

Programme for Accelerated Growth and Employment

Public Finance Management

Poverty Reduction Strategy Paper

Strategy for Poverty Alleviation

Technical, Vocational Education and Training

United Nations Development Programme

List if FiguresFigure I

Summary Revenue 2014

2014 Total Revenue by Category in GMD ('000s)

Deficit Financing 2014 in Dalasi ('000s)

Total Recurrent Expenditure in Dalasi ('000s) by Category in Dalasi ('000s)-GLF, Loans & Grants

Economic Classification of Recurrent & Development Expenditure in Dalasi in Dalasi ('000s) - Loans, Grants and GLF, 2014.

Distribution of the Budget by Ministry/Department in Dalasi ('000S) - Loans, Grants and GLF

Distribution of the Budget by Ministry/Department in Dalasi ('000S) GLF Only

Summary of Discretionary and Poverty Programmes - Loans, Grants and GLF

Poverty Programme by Category in Dalasi ('000s) - Loans, Grants and GLF

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Education Expenditure for 2014

Agriculture & Natural Resources Expenditure - 2014

Health Expenditure-2014

Social Fund for Poverty Reduction Expenditure-2014

Implementation and Monitoring of SPA II

Deficit Financing

Overview of Poverty Expenditure Initiatives-Loans, Grants & GLF in Dalasi ('000s)

Planned Recurrent and Development Spending by Ministries and Departments in 2014

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

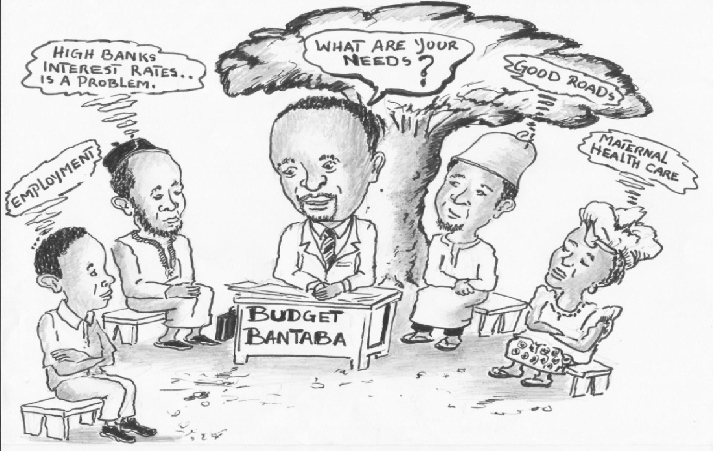

The Gambia like most countries in Africa and the rest of the world currently only practice the conventional system of public budgeting. However, due to the need to better reflect the citizen's requirements in the national budget, and to enable accountability to them for use of money raised on their behalf, the government of The Gambia through the Ministry of Finance and Economic Affairs (MOFEA) has recently adopted the citizens budget concept. By so doing, the citizens will be able to determine if their needs and interests are adequately catered for in the national budget so that they are better able to relate with and take advantage of the budget.

Through this, it is hoped that the ministry will be able to disseminate the budget to the general public in a format that will be understood by them. This citizens budget version is a representation of the approved conventional budget of 2014 and thus the Citizens Budget Book for 2014. Citizens budgeting is a comprehensive format and robust process of budget consultations, preparation and monitoring of its implementation. However, good as it is, very few countries in the world adopt the full citizens budget process (compliance) as recommended by the IMF. Many countries have adopted citizens budgeting at varying levels of compliance.

The Gambia has just begun the process with the reproduction of the approved conventional budget into a format easily understood by the ordinary citizens. This is the main thrust of the 2014 Citizen Budget Edition. However, come 2015, a more community based consultations budget process shall be deployed and requirements of individuals and communities shall be determined and considered in the generation of the conventional budget, which in turn shall be reproduced into a citizens budget edition. It is hoped that over time and with learning, Government shall be more informed and therefore increase the depth and scope of its budget process, making the conventional budget adequately representative of the individual and community requirements and therefore more compliant with citizens budgeting.

It is hoped that this new process shall ensure more financial accountability of the government to its citizens, which is a hallmark of His Excellency, Sheikh Professor Dr. Alhagie Yahya AJJ Jammeh, President of the Republic of The Gambia.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

I wish therefore on behalf of the Ministry of Finance and Economic Affairs to thank the UNDP for supporting the commencement of the Citizens Budget process in The Gambia by paying for the services of the consultants and Emanic Consulting for undertaking the first attempt at this laudable endeavour.

I thank more specifically His Excellency, Sheikh Professor Dr. Alhagie Yahya AJJ Jammeh, President of the Republic of The Gambia for his wisdom and love of Nation and for which reasons he has provided the environment and space for effective financial governance.

Minister of Finance and Economic Affairs (MOFEA)Republic of The Gambia

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

1.1 What Government

A budget (in accordance with Chapter IX, Part I, Section 152 I, IA, 3A, 4-6; and Government Management and Accountability Act 2004) explains how government intends to raise money and spend it in meeting its obligations to the citizens. The 2014 budget is a compilation of all the revenues that Government intends to both collect and spend to meet two things:

1. Maintain the running of government (Recurrent Budget) and2. Continue or initiate development programmes (Development Budget).

This version of the 2014 Budget, namely the Citizen's Budget Edition, is a translation in simple non-economic language of the conventional budget presented to the National Assembly by Government and approved for implementation.

This citizens budget is aimed at civil society so that they will further repackage it in formats most suitable for communication to varying target audiences. It is hoped that all citizens will be able to use this budget and increase their involvement in the economy so that economic activities will be more intense with growth and employment achieved.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Promises Government

In December 2013, the Honourable Minister of Finance presented to the National Assembly, the Budget for 2014, which marks the third year of implementation of the PAGE (Programme for Accelerated Growth and Employment). The PAGE is an off shoot of the VISION 2020, which seeks to make The Gambia a middle income country by the year 2020 and therefore a medium term tool for delivering the development promised in Vision 2020. It is anchored on generating economic development that creates employment.

The 2014 budget is the annual tool for delivering the PAGE promises and among other things seeks to achieve:

Continuation of implementation of the development promises of the PAGE, which started in 2012; now in its third year.

An increase in the rate at which the PAGE is achieved.

A reduction in spending and costly borrowing from Gambians to 2.5% of GDP and if possible to 0% of GDP.

Taking advantage of the achievements of the PAGE so far and ensuring

sustainable development; which means continuing to invest in agriculture (to achieve food self sufficiency as envisaged in Vision 2016) and the productive sectors (Science and Technology, Infrastructure and Energy); all aimed at ensuring poverty reduction. This will be done in cooperation with development partners as government continues to seek meeting its obligations to all Gambians.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

The 2014 budget means so much to the citizens, including that:

The government is in its third year of implementing the PAGE (delivering development and poverty reduction).

II. The Government is focusing on reducing the financing gap between spending

and the availability of money so that debt will significantly be reduced and more money will now be available for development programmes. It is hoped that this will increase economic activity, output, and employment and therefore reduce poverty.

III. By reducing the government domestic debt, interest rates will stabilize and this

will enable money to be in the hands of the private sector so that they will invest more in their businesses, employ more people, produce more goods and services and raise more money for government to spend on public goods and in the process make sure that there is continuous growth in the years to come.

IV. The total revenue

revenue that government expects to generate internally in 2014 is

V. The total spending (expenditure) that government intends to undertake is

D10,222,675,000.

D10,222,675,000. This means that there is a revenue gap, which will be funded from foreign borrowing and grants, amounting to D1,

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Economic Opportunities and Challenges and how it Impacts What Government Plans

The Gambia is a member of the world community and so what happens in other countries affect us. In the same vein, what happens in The Gambia affects the world. Therefore, the 2014 budget is based both on what happens in The Gambia and the rest of the world and how it affects how much money government can raise from within The Gambia and abroad, which in turn affects how much spending Government can undertake.

The 2014 budget was prepared based on the following global and domestic realities:

The world economy since the financial crisis has not been stable. However, it has in 2014 entered another phase of resumed growth in the most developed countries.

II. World average economic growth is about 2.5%, with the US being the main

driver of this growth.

III. In Sub-Saharan Africa, growth is expected to rise to 5% in 2012 and to 6% in

2013 because of increase in consumption in the region and investment in commodities such as oil.

IV. The Gambia's economic growth for 2013 was estimated at 5.6%; very

competitive to Sub-Saharan Arica (6%); and the rest of the world (2.5%), although dropping from 6.1% for 2012.

V. This growth in The Gambia was made possible from agriculture(22.2% to GDP):

increase in crop production, livestock, forestry and fisheries, industrial (14.8% to GDP) sector: the Construction sub sector, electricity & water mainly due to the expansion in rural electrification services (57.1% to GDP); and tourism, communication, financial services and real estate. The lower growth rate in 2013 is as a result of a decline in international trade.

VI. The services, agriculture and industry continue to be the pillars of the economy,

jointly contributing 94.1% to economic growth.

VII. In 2013, the overall balance including grants at the end of the first nine months

is a deficit of D1.7 billion or 4.9 per cent of GDP compared to a deficit of D733 million or 2.5 per cent of GDP in the corresponding period of 2012. In 2013, the revised deficit was projected at D2.4 billion or 7 per cent of GDP.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

The value of the dalasi against the main currencies, namely the US Dollar

and the Euro affects the level of prices in The Gambia, since most international transactions are conducted in these currencies: imports and exports. In 2013 and from end-September 2012 to end-September 2013, the Dalasi depreciated by 1.79 % against the US Dollar, 6.05 % against the Euro and 5.75 % against the pound Sterling. The depreciation of the Dalasi against the US Dollar during the review period has been gradual and partially influenced by policy measures.

Expenditure 2014

The 2014 budget is a projection of planned expenditure (on goods and services by government) both to maintain government and continue or initiate development projects/programmes; and how it will raise the money to meet this planned expenditure. In this case, it could be said that what and how the 2014 budget will be achieved partly depends on how its planned revenues are affected by the following issues:

If the general price level is too high, the cost of supplies and services may be far

higher than the amounts of money shown in and approved in the 2014 budget. In this case government will need more than the amounts planned.

II. If the expected sources of revenue did not bring as much money as was planned,

some of the services promised in the 2014 budget will not be delivered.

III. If due to difficulties in the global economy, grants and loans as

projected/expected do not come through, this will also affect the delivery of some of the services promised by the 2014 budget.

2.3 What Government

In 2014, government wants to deliver some of the development promises of The Gambia Vision 2020 and the PAGE. The budget is an instrument both for achieving short and long term development on an annual basis and therefore the policy objectives of the 2014 budget includes aspects of the PAGE that can be implemented if there is enough revenue, and as the PAGE is being successfully implemented, so too will be the long-term development objectives of Vision 2020.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Objectives/Challenges

Objectives/Challenges Government

In 2014, Government intends to achieve and deliver the following to the citizens of The Gambia:

2015 expected to be 8.3%,

inflation at 5.5% in

2013 and fall to 5.0% in 2015. This means the economy will grow by about 8.3%, whilst inflation is kept at a low of 5.5% in 2014, giving more value to the citizens.

2. Domestic borrowing

borrowing (e.g. Treasury bill sales) to be reduced to 2.5 per cent of

GDP by end 2014. This way, revenue will move away from paying high interest rates on borrowing to sectors like agriculture, infrastructure and etc. all of which will lead to more economic growth, employment and the wellbeing of Gambians.

3. Budget deficit

Budget deficit to be significantly reduced. Projected budget deficit for 2014 is

3.7% of projected GDP . Deficit reduction (gap between revenues and expenditure) gives government a stronger leeway in deciding on where to spend its resources and more self-reliance in funding national development.

MTEF roll-out to the Ministry of Health and Social Welfare (MOHSW)

and the Ministry of Agriculture (MOA).

5. Increase government revenue,

revenue, improve tax administration,

administration, and reduce tax

evasion through the full implementation of VAT and other tax reforms such as harmonization of the PAYE tax system and full operationalisation of the tax tribunal.

1 Call Circular 2013 - 2015

2 Call Circular 2013 - 2015 & Approved Budget 2014

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

ChallengesIn reaching the above policy objectives Government will need to overcome critical challenges/difficulties in the various sectors. To rationalize the priorities of development, government divides and approaches development investment in the following three (3)

Productive Sectors

The productive sectors (environment,

(environment, parks and

life, tourism and

transport, works

infrastructure; fisheries and water resources and trade)

trade) succumb to the following

Resource constraints in growth in sectors such as Energy and infrastructure.

Inadequate beds especially in the four and five star categories and poor

product diversification of the tourism sector.

Poor international (EU) quality standards and non-full implementation of the

ECOWAS trade protocols, which hampers trade effectiveness.

Inadequate ICT coverage and quality in the communication sector.

Inadequate/poor water drainage and sewage System.

Poor feeder road network.

II. Social Sectors

The following constitute the challenges in the social sectors (basic and higher education, health and social welfare):

Relatively low quality at the basic and secondary levels.

Inadequate teaching staff.

Low coverage and diversification of TVET programmes.

Growing rate of child abuse and poverty.

Relatively low staff motivation and morale.

Cross Cutting Sectors

These are sectors have an impact on all other sectors since they are enabling sectors and also suffer from various challenges.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Government's Chosen Policy Measures for Achieving the Policy Objectives/ Challenges

To achieve the 2014 budget objectives government will need money and with it take certain investment actions in the sectors of priority. The actions

A. Revenue Measures

The revenue measures are the actions that Government have initiated to generate the necessary revenue (money) to meet the implementation of policy actions by which the development objectives may be achieved.

In 2014, these measures include:

To raise specific excise on tobacco products from D5 per pack to D9 per pack and environmental tax rate on tobacco products from D0.20 per pack to D2.10 per pack;

II. To raise the specific excise on other tobacco products from D37.50 per kilogram

to D150 per kilogram and environmental tax rates on other tobacco products and from D75 per kilogram to D100 per kilogram;

III. To increase the presumptive tax base for commercial vehicles and boats;

IV. To include customs duties and other charges in the base for excise tax

V. To reduce the corporate tax rate by 1 per cent to 31 per cent in line with

Government commitment to lower the corporate tax rate to regionally competitive level; and

VI. To introduce air transport tax on the sale of air tickets at the rate of 15 per cent.

This replaces the sales tax, which was abolished in 2012.

With the required money raised, the following actions shall be taken by Government in the priority sectors. The intension is continue and/or initiate development programmes such

Youth and sports, interior, defense, justice, finance and economic affairs, pensions and gratuities, ombudsman, local government and lands, office of the president, national assembly judiciary, independent electoral commission, public service commission, national audit office, foreign affairs

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

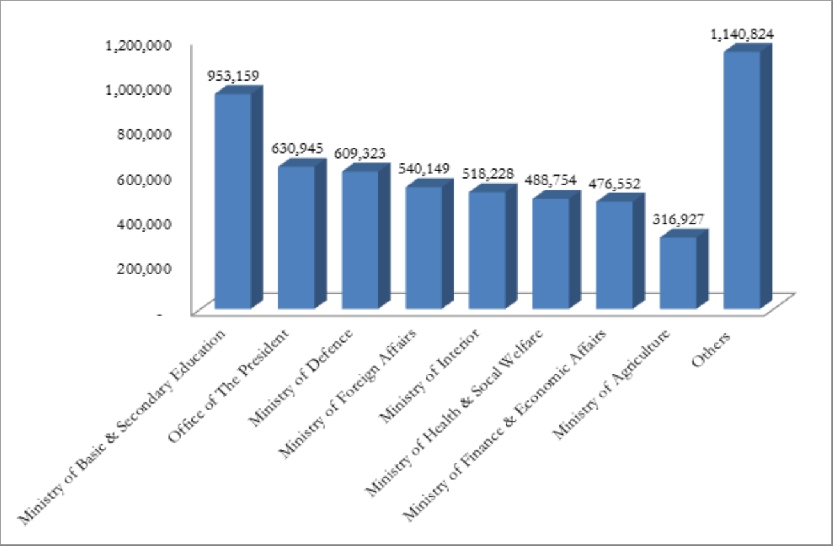

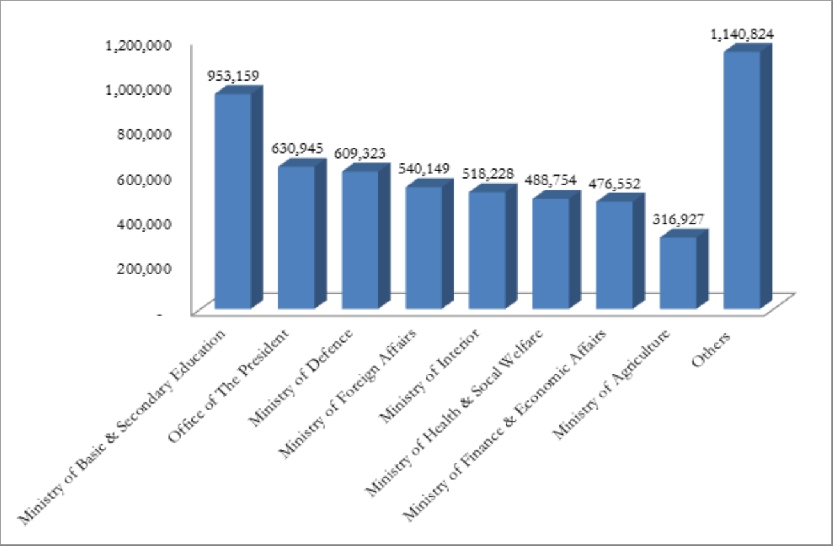

Figure VII: Distribution of the Budget by Ministries - GLF Only in GMD (000s')

NB: Others

Others the

following

following

1. Ministry of Transport, Works & Infrastructure2. Ministry of Environment Parks & Wildlife; 3. Ministry of Tourism & Culture;4. Ministry of Trade and Regional Integration5. Ministry of Energy;6. Ministry of Petroleum;7. Ministry of Information & Communication Infrastructure;8. Ministry of Fisheries & Water Resources9. Ministry of Youth & Sports;10. Ministry of Justice;11. Pensions & Gratuities;12.

13. Ministry of Lands and Regional Government;14. National Assembly;15. Judiciary;16. Public Service Commission;17. National Audit Office and18. Miscellaneous

12 Estimates of Revenue and Expenditure 2014, Page 18 & 19 - Expenditure Budget Overview by Item: Departmental Recurrent & Development Budget -GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

II. Higher Education,

Education, Research,

Research, Science &

Strengthen partnership with development partners including scholarships for

studies abroad;Expand and diversify TVET programmes;

Operationlise the Kanilai Institute of Technology;

Construct the University of The Gambia Faraba Campus;

Encourage the establishment/operationalisation of the Mahatma Gandhi

University of India, EUCLID University, West Africa Science Service Centre on Climate Change and Adapted Land Use (WASCAL), and the African Virtual University

Intensify immunization programmes including the introduction of new vaccines

for Pneumococcal diseases, Measles (Second Dose) and Rota Vaccine; andDecrease Malaria prevalence and TB treatment success rates through the

expansion of the Directly Observed Treatment Short Course Centers.

Increase child protection committees for vulnerable children;

Continue the provision of Educational sponsorship packages and psycho-social

support for orphans; and family-strengthening program for vulnerable members of society.

V Personnel Management

Personnel Increase staff motivation through training/development and loan facilities.

Increase youth employment through business activities including farming (youth

Intensify sensitization of key stakeholders such as women, traditional and

Religious Leaders, the Police, Child Welfare Officers and Gender Focal Points on the Women Act 2012 and Gender and Empowerment Policy 2010-2020.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

III. Foreign Affairs

Foreign The Government will continue to deepen and expand its bilateral and multilateral

cooperation, friendship and concord based on mutual respect, national interest and reciprocity. In this regard, the Ministry of Foreign Affairs will undertake a review process to rationalize our foreign missions and their respective areas of jurisdiction in line with the country's interest.

Improve working and living conditions of the armed and security services; and

Increase participation in ECOWAS, AU and UN peacekeeping missions.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Where Government Plans to Raise and Spend Money in 2014

Where the Money is Coming From and How

Based on the above revenue and other policy measures, Government targets to collect the following revenue:

Total revenue targeted for collection in 2014, including grants is D8, 557, 701, 000.

Reference: Estimates of Revenue and Expenditure 2014, Page 1 - Budget Overview

Out of a total revenue of D8,

999, 000 (77%) is

domestic revenue

D1, 997, 702 (23%) is grants.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

3.2 How Government Plans to Spend.

3.2.1 Expenditure

In 2014 government plans to spend D10, 222,675 (excluding debt ser

Total expenditure shows an increase from 2013 of 16.3%.

Figure V: Economic Classifications of Recurrent & Development Expenditure in

Dalasi ('000s) - Loans, Grants & GLF .

Estimates of Revenue and Expenditure 2014, Page 17 Departmental Overviews: Departmental Recurrent & Development Budget-Loans, Grants & GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Figure II: 2014 Total Revenue by Category in GMD ('000s)

Of the Total Tax Revenue (D5, 770,

000) to be collected in 2014:

D2,658,816,000 (46.08%) will be from Goods and Ser

D2,658,816,000 (46.08%)

vices representing an

increase of 19.69% from 2013,

D1,398,826,000 (24.2%) from International trade and

D1,398,826,000 (24.2%)

Transport, an increase

D1,582,357,000 (27.4%) from

D1,582,357,000 (27.4%)

Tax Profits and Capital Gains, an increase of

D55,000,000 (1%) from Payroll,

an increase of 19.57%,

D49,000,000 (0.8%) from property

D49,000,000 (0.8%)

, an increase of 2.0%, and

D26, 000 (0.5%) from other taxes,

an increase of 0%.

Reference: Estimates of Revenue and Expenditure 2014, Page 1 - Budget Overview.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Table I: Deficit Financing

Category

Domestic Borrowing

Foreign Amortisation

Arrears & Guarantees

Foreign Barrowings

Figure III: Deficit Financing

6 Estimates of Revenue and Expenditure 2014, Page 1 - Budget Overview.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

3.2 How Government Plans to Spend.

3.2.1 Expenditure

In 2014 government plans to spend D10, 222,675 (excluding debt ser

Total expenditure shows an increase from 2013 of 16.3%.

Figure V: Economic Classifications of Recurrent & Development Expenditure in

Dalasi ('000s) - Loans, Grants & GLF .

Estimates of Revenue and Expenditure 2014, Page 17 Departmental Overviews: Departmental Recurrent & Development Budget-Loans, Grants & GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Expenditure and Net Lending

Foreign: D 0.2 Million (D200 million)

Domestic: D1.4 Billion

Personnel: D2.1 Billion

Expenditure: D8.6

Other Current: D3.8 Billion

Capital: D2.7 Billion

Lending & Equity Participation: D 0.05 Billion (D5 Million)

Repayments from Government

(D -40 Million)

8 Estimates of Revenue and Expenditure 2014, Page 10 Expenditure Budget Overview by Item: Departmental Recurrent & Development Budget - Loans, Grants & GLF. 9 Estimates of Revenue and Expenditure 2014, Page 1 - Budget Overview.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

3.2.2 How Government will Distribute Recurrent and Development Expenditure between Departments and Ministries

In 2014, government plans to spend the following amounts in the various ministries and departments to both sustain or run government (recurrent expenditure) and fund projects/programmes:

Table III: Planned Recurrent and Development Spending by Ministries and Departments in 20141

Difference

Percentage of

(2014-2013)

Total (2014)

Office of the President

N a tional Assembly

Independent Electoral Commission

National Audit Office

Ministry of Defence

Ministry of Interior

Ministry of Tourism & Culture

Ministry of Foreign Affairs

Ministry of Justice

Ministry of Finance and Eco

Ministry of Local Government and

Ministry of Agriculture

Ministry of Transpo rt, Works &

Ministry of Trade, Regional Integration

f Basic and Secondary

Ministry of Health and Social Welfare

Ministry of Youth and Sports

Ministry of Environment, Parks &

Ministry of Information Technology

Ministry of Forestry and Water

Ministry of Higher Education, Research,

Science and Technology

Ministry of Energy

Ministry of Petroleum

7,280,30 7

8,642,446

Estimates of Revenue and Expenditure 2014, Page 18 & 19 Expenditure Budget Overview by Item: Departmental Recurrent & Development Budget - GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

3.2.3 Highlights of the T

3.2.3 Highlights of the op Spending Ministries

IV. Figure VI: Distribution of the Budget by Ministries/ Loans, Grants & GLF in GMD (000s')

Ministry of Environment Parks & Wildlife;

Ministry of Tourism & Culture;

Ministry of Trade and Regional Integration

Ministry of Energy;

Ministry of Petroleum;

Ministry of Information & Communication Infrastructure;

Ministry of Fisheries & Water Resources

Ministry of Youth & Sports;

Ministry of Justice;

10. Pensions & Gratuities;11. Ombudsman;12. Ministry of Lands and Regional Government;13. National Assembly;14. Judiciary;15. Public Service Commission;16. National Audit Office and17. Miscellaneous

11 Estimates of Revenue and Expenditure 2014, Page 16 & 17 - Expenditure Budget Overview by Item: Departmental Recurrent &

Development Budget - Loans, Grants & GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Figure VII: Distribution of the Budget by Ministries - GLF Only in GMD (000s')

NB: Others

Others the

following

following

1. Ministry of Transport, Works & Infrastructure2. Ministry of Environment Parks & Wildlife; 3. Ministry of Tourism & Culture;4. Ministry of Trade and Regional Integration5. Ministry of Energy;6. Ministry of Petroleum;7. Ministry of Information & Communication Infrastructure;8. Ministry of Fisheries & Water Resources9. Ministry of Youth & Sports;10. Ministry of Justice;11. Pensions & Gratuities;12.

13. Ministry of Lands and Regional Government;14. National Assembly;15. Judiciary;16. Public Service Commission;17. National Audit Office and18. Miscellaneous

12 Estimates of Revenue and Expenditure 2014, Page 18 & 19 - Expenditure Budget Overview by Item: Departmental Recurrent & Development Budget -GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

3.2.4 Share of Poverty Expenditure During the PAGE Period

3.2.4 Share of Poverty Expenditure During the P

The detailed distribution of Poverty Expenditure Initiatives is shown in Table II below.

Table II : Overview of Poverty Expenditure Initiatives-Loans, Grants & GLF in Dalasi ('000s)1

Difference

Percentage of

(2014-2013)

Total (2014)

2,271,196

2,072,430

2,962,041

1,788,666

5,207,875

5,639,232

Agriculture & Natural Resources

Extension Services

esource Management

Regulatory & Control Services

Decentralisation & Local

Government Capacity Building

Decentralisation & Local

1,316,100

1,797,511

Improving Access to Basic Education

Improving Quality of Teaching &

Increasing Access to Non-formal

Increasing Duration of Instruction

Upgrading Teaching & Learning

Government Civil Service Reform

Government Civil Service Reform

Access & Quality of Basic Health

Planning & Evaluation of Health

Social Welfare Programme

ICT Research & Development

esearch & Development

Implementation & Monitoring of

Public Sector Management

Poverty Monitoring System

1,530,487

1,360,371

Nutrition, Population & HIV &

Programme Delivery at Micro Level

Social Fund for Poverty Reduction

Community Development Programme

Microfinance Programme

Small Enterprise Development

Support to Cross-Cutting

Programmes

4,059,862

7,280,305

8,601,273

13 Estimates of Revenue and Expenditure 2014, Page 18 & 19 - Overview of PRSP/PAGE Initiatives-Loans, Grants and GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Summary of Discretionary and Poverty Programmes

Summary of Discretionary and Poverty Programme

Figure IX: Poverty Programme by Category Loans, Grants & GLF in Dalasi ('000s),

Estimates of Revenue and Expenditure 2014, Page 18 & 19 - Overview of PRSP/PAGE Initiatives-Loans, Grants and GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

3.2.5 Spending in Critical Sectors

In 2014 the following will be spent in the key critical sectors:

Basic and Secondary Education

Basic and Secondar

In Education government plans to spend D1,

D1, 797,511,000(31% of

797,511,000(31% total

expenditure), an

2013.The following activities will be funded:

(D964, 929,000) will

be spent on Improving Access to Basic Education; an

increase of 22.33 % from 2013.

be spent on Improving Quality of Teaching & Learning,

an increase of 37.4% from 2013.

(D11, 733,000) will be spent on Increasing Access to Non-formal

Education; a decline of -92.65% from 2013.

100,000) will be spent on Increasing Duration of Instruction Time; an

increase of 1,082.00% from 2013.

(D748, 559,000) will be spent on Upgrading Teaching & Learning

Materials of 112.06% from 2013.

Estimates of Revenue and Expenditure 2014, Page 18 & 19 - Overview of PRSP/PAGE Initiatives-Loans, Grants and GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

In Agriculture and Natural Resources government plans to spend D657,

D657, 982,000(11.7%

expenditure), an increase of -15.15% from 2013. The following activities will be

462,000) will be spent on Natural Resource Management - an

increase of 23.0% from 2013.

387,000) will be spent on Regulatory & Control Services - an

increase of 14.16% from 2013.

(D17, 034,000) will be spent on Water Management - an increase of -

95.08% from 2013.

Estimates of Revenue and Expenditure 2014, Page 18 & 19 - Overview of PRSP/PAGE Initiatives-Loans, Grants and GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

In health government plans to spend D484,

755,000 - an increase of 9% from 2013. This

amount is going to be spent on the flowing activities:

261,000) - Access & Quality of Basic Health -

- an increase of 14%

from 2013.

21 %(

D102, 755,000) -

755,000) Planning & Evaluation of Health Sector - an increase of

0.497% from 2013. 1% (D4,

(D4, 739,000) - Social Welfare Programme an increase of -55% from

17Estimates of Revenue and Expenditure 2014, Page 18 & 19 - Overview of PRSP/PAGE Initiatives-Loans, Grants and GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

In the social fund for poverty reduction, government plans to spend D305,

2013.This amount is going to be spent on the following activities:

843,000) Community Development Programme - an increase of

75% from 2013.

381,000) - Microfinance Programme - an increase of 7% from 2013.

(D277, 935,000) - Small Enterprise Development Programme an

increase of 19% from 2013.

Implementation and

18 Estimates of Revenue and Expenditure 2014, Page 18 & 19 - Overview of PRSP/PAGE Initiatives-Loans, Grants and GLF.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

New Initiatives and Contributions to Policy Objectives

The mains budget initiatives in 2014 include the revenue measures shown in 3.1.2A and the following actions:

To intensify the ongoing gradual implementation of the Medium Term Expenditure Framework (MTEF) through the various Ministries, Departments and Agencies (MDAs) helps to ensure that planning and budgeting are done over a medium term period in a more transparent and participatory process.

II. To ensure that the 2014 budget will focus on fiscal prudence aimed at

minimising the growing deficit being financed by costly domestic borrowing, which will include containing the Net Domestic Borrowing (NDB) to 2.5 per cent of GDP by end 2014 and to near zero per cent by end 2016. The objective of this policy is to contain inflation, stabilize the Dalasi and to increase domestic savings for program financing.

III. To intensify sustainable agricultural development as a priority for Government,

especially in the new Vision 2016 that is anchored on being food self sufficient by the year 2016. The Government under the stewardship of His Excellency The President of The republic, Sheikh Professor Dr. Alhagie Yahya AJJ Jammeh and the cooperation of its development partners will continue to invest in the agricultural sector, whilst other productive sectors such as Science and Technology, Infrastructure and Energy will remain priorities for Government as key platforms to support poverty eradication.

4.2 Contributions of 2014 Budget to Meeting the Government's Policy Objectives

Over time and in spite of domestic and international economic challenges, the Gambian economy continues to manifest resilience and stability. These characteristics, which provide the basis for the 2014 budget as an effective tool for development and poverty

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

reduction has and are expected to continue to meet the following contributions to the achievement of government policy objectives:

Despite global and domestic challenges including the international financial

crises and the recent draught, The Gambia still remains resilient. Growth is back to its pre-draught level of about 6 per cent of GDP driven mainly by Agriculture and Tourism as the anchor. These sectors continue to attract greater public investment given the expectations of their continued effectiveness in economic growth and poverty reduction endevaours.

II. Although the implementation of the PAGE is progressing steadily with

challenges, its full and successful implementation remains a commitment for Government and the 2014 budget aims as much as possible to contribute to this endeavour in this third year of the programme's implementation.

III. In the area of PFM, it is important to note that significant progress has been

made in terms of reforms and Government will continue on PFM reforms to ensure judicious and optimal mobilization and deployment of public resources. Related to that, Government will continue on procurement reform with the objective of ensuring transparency and effectiveness of the procurement process.

IV. Inclusive growth, fight against inflation, a stable local currency and employment

opportunities remains the medium term goal for Government, and this budget is anchored on these parameters.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

5.1 What Government

Government doing

Government in 2014 is involved in the following reforms to further improve the delivery of services:

Gradual roll out of MTEF to MOHSW and MOA and the institutionalization of

programme based budgeting in all MDAs.

II. Improvements in the banking supervision and settlements through improving on

and proliferation of automated clearing and payments as well as credit risk assessment.

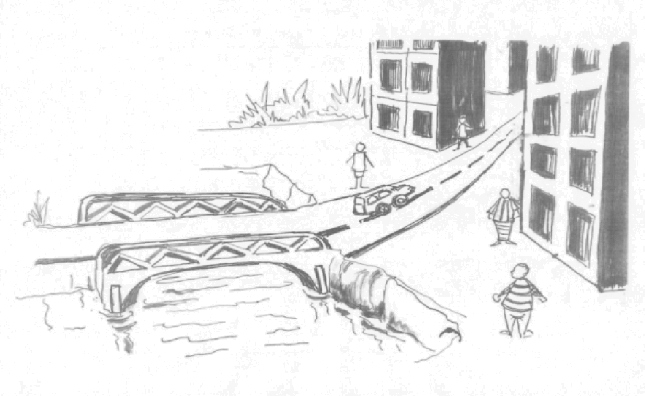

III. Improvements in roads and other infrastructural investments as catalyst for

enabling overall economic growth.

IV. Continuous and more in-depth investments and improvements in education and

health services delivery at all levels.

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

6.1 Photo Gal ery of Development Projects

Soma Mandinaba Road

Cross section of Roads - a major leap in opening

ECOWAS EMERGENCY POWER SUPPLY PROGRAMME

ECOWAS EMERGENCY POWER SUPPLY PROGRAMME

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Views of Banjul New National Assembly

Views of Banjul New National Assembly

Rice Fields - Vision 2016

Animal Husbandry - Vision 2016

The Banjul International Airport

Construction of New Staff Housing at Farafenni

Hospital in North Bank Region

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

1. Estimates of Revenue and Expenditure 2014, The Republic of The Gambia

2. Tanzania's Citizens Budget Edition-2012/13 Financial Year.

3. Open Budget Survey 2012

4. The Citizens Budget Handbook on the Budgetary Process of Kenya, Second

5. OECD Journal on Budgeting, Volume 2010/26. http://www.investopedia.com/dictionary/

Empowering Citizens Through Budgets

Republic of The Gambia Citizens Budget Manual

Validation Exercise of 2014 Citizens Budget and Manual

Date: July 31, & August 1, 2014 Venue: Senegambia Beach Hotel

Mohammed .E. Jammeh

Ansumana L.M Sambou

MANSAKONKO AREA CONCIL

Bansang Area Council

Kerewan Area Council

Banjul Area Council

Janjanburry Area Council

Department of Agriculture

National Assembly

National Assembly

Empowering Citizens Through Budgets

REPUBLIC OF THE GAMBIA

MINISTRY OF FINANCE & ECONOMIC AFFAIRS (MOFEA)

Banjul, The Gambia

Tel: +220 422 75 29 422 72 21

Fax: +220 422 79 54 E-mail: [email protected]

Source: http://www.mofea.gov.gm/images/stories/pdf/final.pdf

GUIDELINES FOR THE MANAGEMENT OF THE INFANT WITH NEONATAL ABSTINENCE SYNDROME Background Neonatal Abstinence Syndrome (NAS) is a syndrome of drug withdrawal observed in infants of mothers physically dependent on drugs. Also known as neonatal withdrawal syndrome or passive addiction, NAS is a condition resulting from exposure in utero or postnatal exposure to opioids and other illicit drugs. It is more common in infants born to opioid-dependent women than in infants born to women dependent on other drugs or alcohol.1

Invest New DrugsDOI 10.1007/s10637-011-9730-5 PRECLINICAL STUDIES Enhancing the anti-lymphoma potential of 3,4-methylenedioxymethamphetamine (‘ecstasy')through iterative chemical redesign: mechanismsand pathways to cell death Agata M. Wasik & Michael N. Gandy & Matthew McIldowie & Michelle J. Holder &Anita Chamba & Anita Challa & Katie D. Lewis & Stephen P. Young &Dagmar Scheel-Toellner & Martin J. Dyer & Nicholas M. Barnes & Matthew J. Piggott &John Gordon